Overtime, Comp Off & CV

Manage

Overtime

& Compensations

Manage additional receivables.

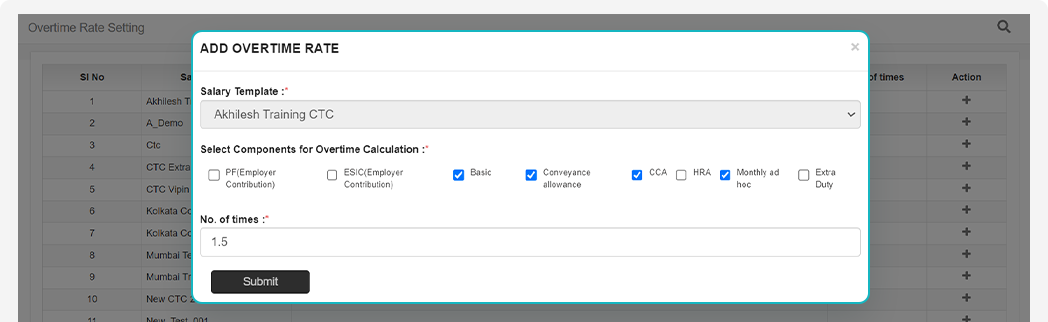

Calculate Overtime Payout

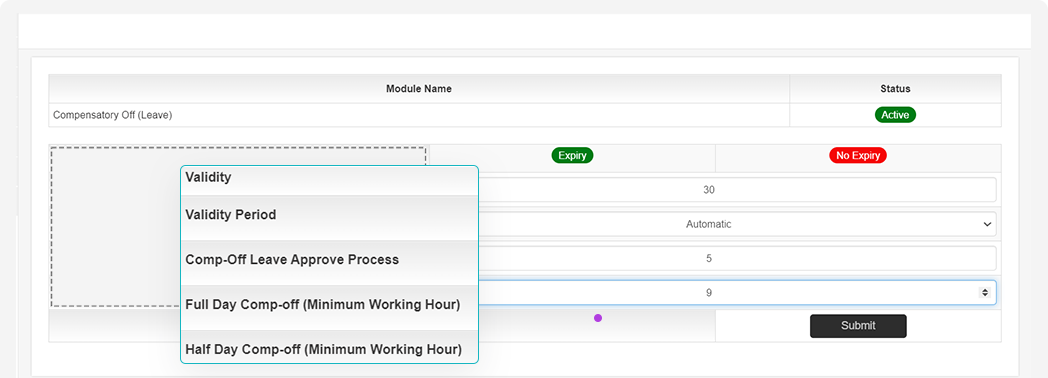

Reporting managers can easily track employee overtime, and the system will flag employees whenever their overtime quota is breached as per compliance rules. You can also allot compensatory offs to employees who work on holidays or choose to pay them based on their extra duty hours.

Compensatory Off Management

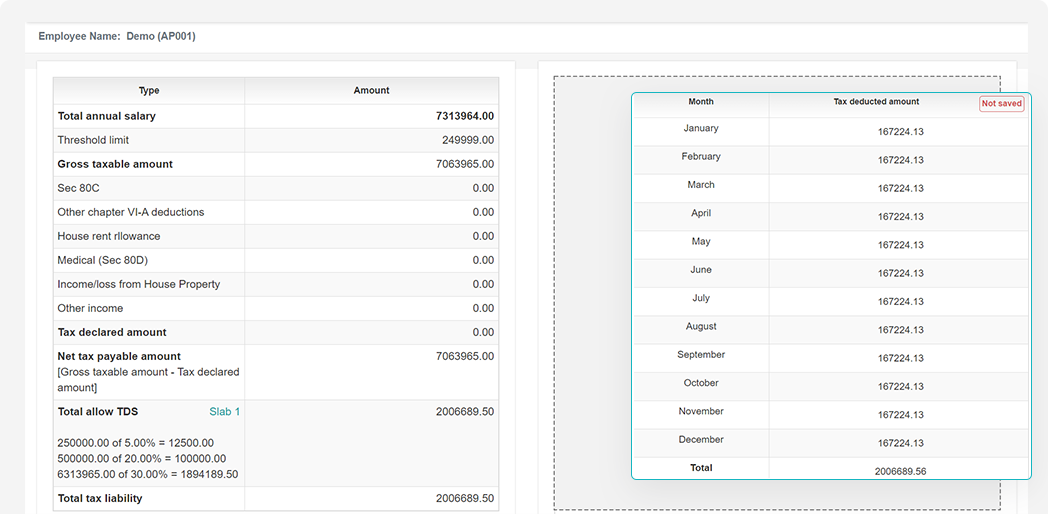

Automated TDS

Automated Tax

Deduction System

Automate TDS computation.

TDS Chart

eclare tax-saving investments that can be approved by HR and used to calculate TDS as per the selected regime for monthly deductions. You can also add manual TDS on a monthly basis, which can be triggered into the payroll as per offline calculations if you choose not to automate TDS computation.

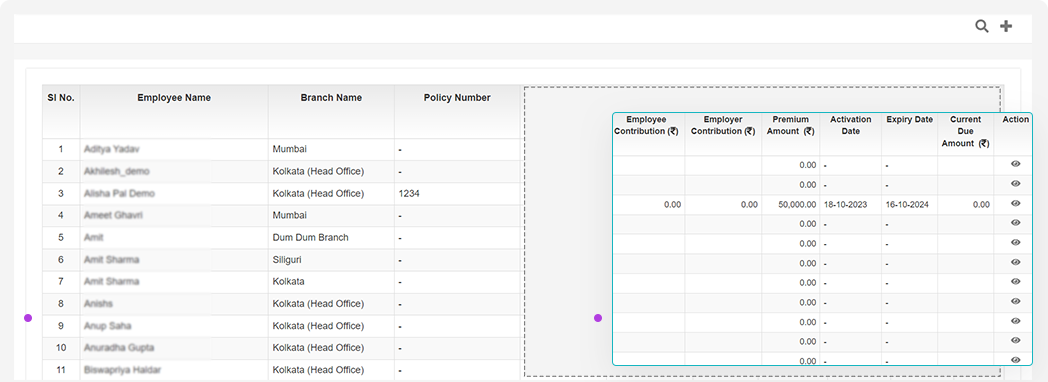

Loans, Advances, Mediclaim

Administer Loans

& Mediclaim

Manage & Track

Manage Employee Mediclaim

You can also record employee mediclaims, which can be split between the employee and employer, and the respective deductions can be carried out through automated EMIs. Employees can apply for loans and advances in the system, and a repayment chart—which automatically triggers into the payroll—can be generated.

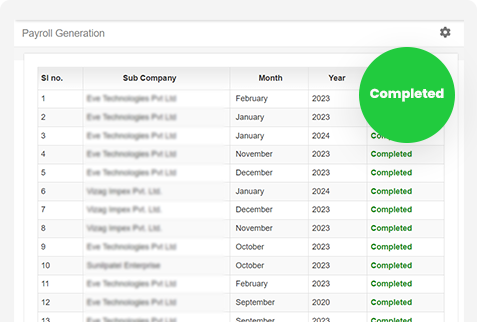

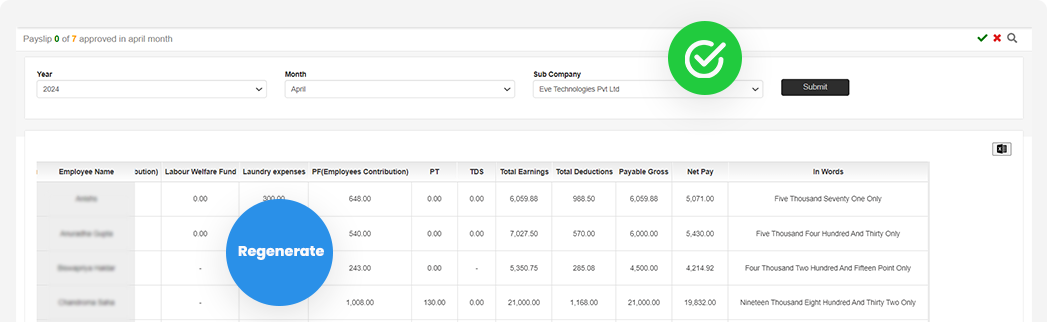

Payroll & Payslip

Payroll & Payslip

Generation

Process Payroll, Generate Payslips.

One of the critical features of EVE 24 HR software is its comprehensive payroll management capabilities. HRMS software can automate the process of calculating and generating paychecks, saving time and reducing errors. It also provides valuable insights into your payroll data. The payroll module handles salary calculations, tax deductions, and payslip generation.

Generate Payroll

Approve Payslips

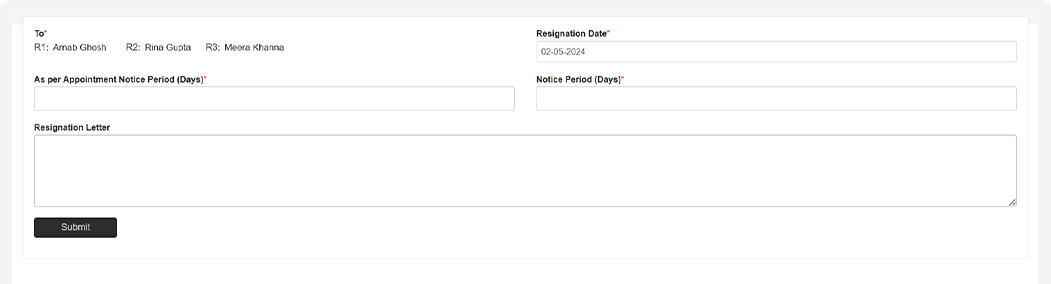

Resignation

StreamlineResignation

Management

Initiate E-Seperation.

An Employee initiates the resignation process by submitting a resignation request through the EVE. The request is routed to the respective manager and HR for approval.

Apply Resignation

EVE provides a comprehensive offboarding process to ensure that departing employees leave on good terms while protecting company assets and knowledge. The offboarding feature includes automated workflows for asset returns, access revocation, full and final settlement, gratuity computation, and knowledge transfer. With this system, HR teams can efficiently manage the offboarding process, maintain positive relationships with departing employees, and safeguard company interests.

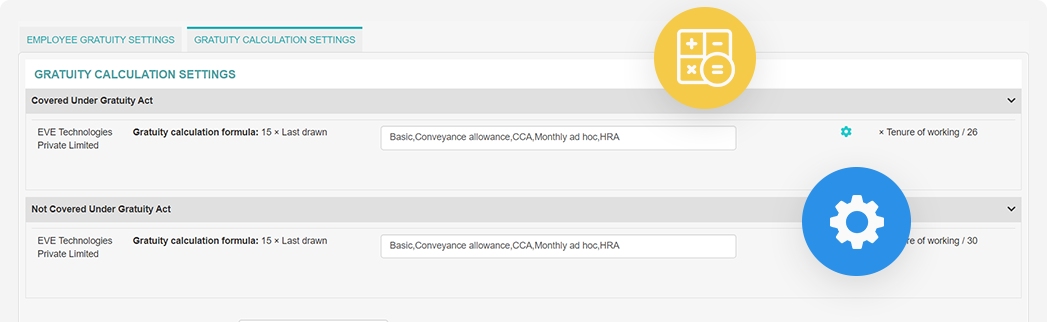

Gratuity & FNF

Compute Gratuity

Full & Final Settlement

Handle gratuity, process FNF.

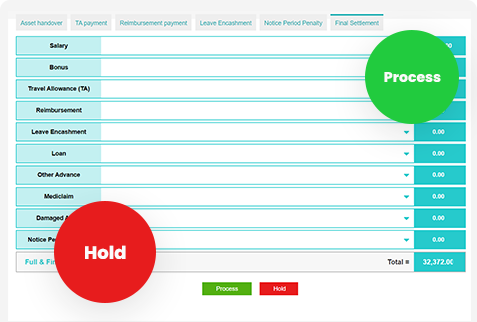

Calculate For

Process FNF

EVE calculates the employee's final dues, including salary for the notice period, unused leave, travel allowances, reimbursements, and bonuses (if applicable). Deductions such as taxes, loans, or advances are also calculated based on the company's policies. EVE then generates a Full and Final settlement statement, providing a detailed breakup of the final settlement amount, which is processed for payment to the employee within the stipulated time frame/TAT.

Frequently Asked Questions

-

Can EVE handle shift scheduling and management?

Yes, EVE has modules for shift scheduling and management. These modules can help HR managers create and manage employee schedules, track attendance, and ensure proper staffing levels.

-

Can employees request leaves through EVE?

Yes, EVE offers self-service features that allows employees to request leaves, which are then sent to their supervisors for approval.

-

How does EVE handle different types of leaves (sick leave, vacation, etc.)?

EVE offers leave management modules that allow employees to request different types of leaves. The system can then track the types of leaves taken by each employee.

-

How does EVE handle company policies?

EVE can store company policies and make them accessible to employees. They can also track employee acknowledgment of policies and ensure compliance with them.